Gold Card Visa Can Be Fun For Anyone

Table of ContentsGold Card Visa - An OverviewHow Gold Card Visa can Save You Time, Stress, and Money.10 Simple Techniques For Gold Card VisaEverything about Gold Card VisaGetting The Gold Card copyright WorkRumored Buzz on Gold Card VisaAll about Gold Card Visa

Notably, these quotes only model local job creation. Such designs are not with the ability of establishing whether a financial investment enhances accumulation, nationwide employment. There is little strong, empirical proof that the EB-5 program as built today produces significant task development that wouldn't happen without the program. Job development is absolutely one of the main benefits of Foreign Direct Financial Investment (FDI), however when the process takes nearly 6 years and still only creates speculative estimates of task production, it's time to think about options.

The Only Guide to Gold Card Visa

In this instance, the restricting element on the amount of earnings a Gold Card could produce is the number of candidates eager to pay this fixed cost. According to price quotes from Knight Frank, a realty consultancy, there are regarding 1.4 million people living outside the United States with a total assets of at the very least $10 million.

Congress ought to go better and spare all CBP jobs from GSA's testimonial if it chooses to use the Gold Card Visa earnings for tasks at ports of entry. Gold Card Visa financing can likewise be used to rectify voids in CBP staffing.

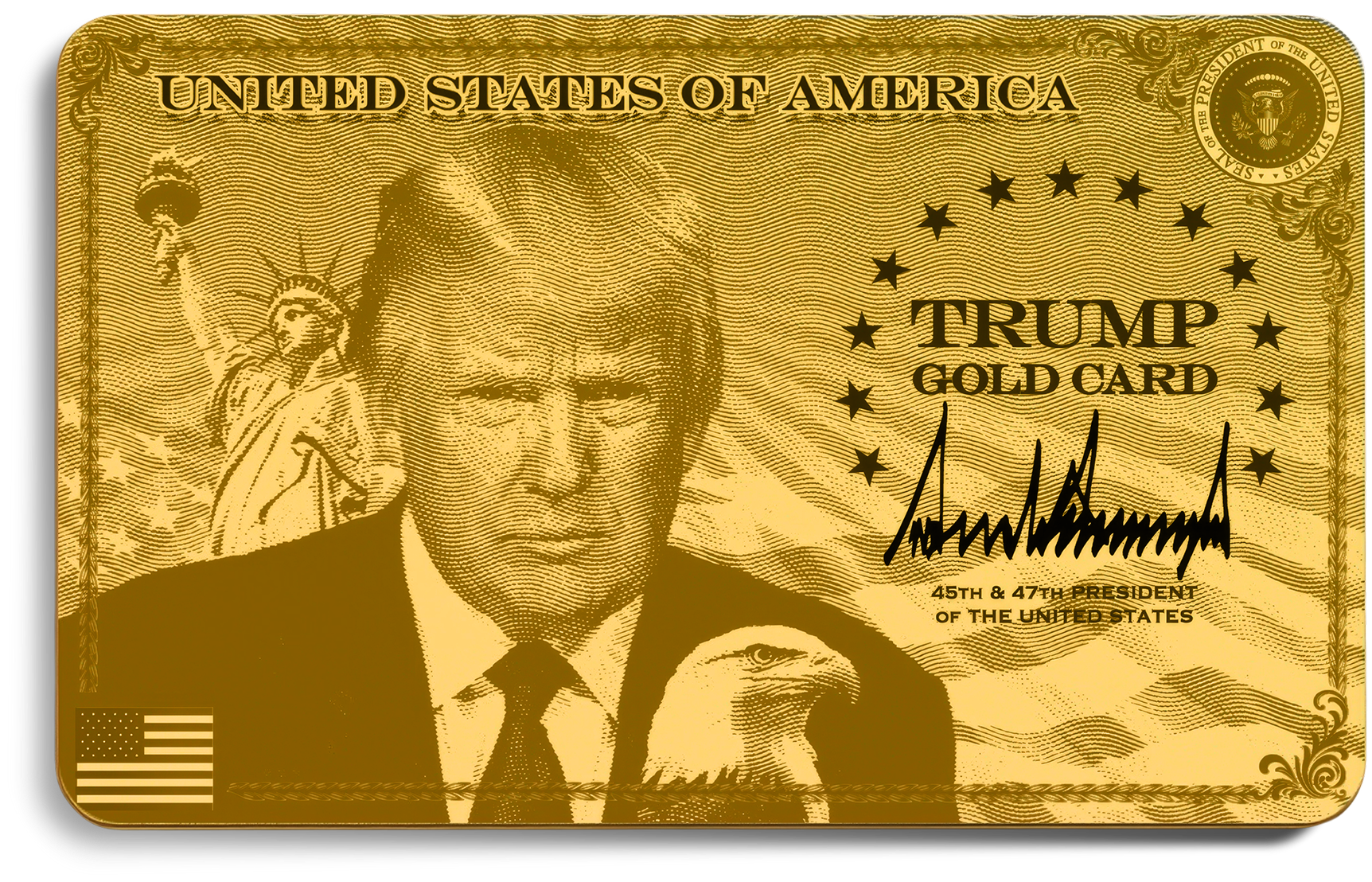

Today, Head Of State Donald J. Trump authorized an Executive Order to create the Gold Card visa program, facilitating expedited immigration for aliens that make substantial financial presents to the United States. The Order guides the Assistant of Business, in control with the Assistants of State and Homeland Security, to establish a "Gold Card" program.

How Gold Card Visa can Save You Time, Stress, and Money.

The Order instructs that these presents act as evidence of exceptional company ability and nationwide benefit, speeding up adjudication regular with lawful and safety and security worries. The Order routes the Secretary of Commerce to deposit the presents into the Treasury and use them to advertise business and American market. The Order needs the Secretaries to take all needed and ideal steps to carry out the Gold Card program, including developing application procedures, costs, and potential expansions to various other visa groups.

President Trump is functioning non-stop to undo the dreadful plans of the Biden Administration to drive unprecedented financial investments to America. Early in his 2nd term, Head of state Trump proposed Gold Cards, a vision he is currently delivering to bring in affluent financiers and business owners. President Trump's steadfast dedication to renewing American sector has actually stimulated trillions of bucks in international financial investment promises.

Combined with the simultaneously-issued Presidential Pronouncement entitled "Constraint on Access of Particular Nonimmigrant Employees" on the H-1B Program calling for employers to pay $100,000 per H-1B request (see Saul Ewing's recap below), there is much supposition about the Gold Card Program. While the Gold Card Program has yet to be enacted, many concerns stay because of the issuance of the Exec Order.

The Best Strategy To Use For Gold Card Visa

revenue." The Gold Card and the Platinum Card for that reason seem created to operate within Congressionally-authorized visa processes and do not, as anticipated, create a new visa program that was not formerly authorized by Congress. It is feasible, nevertheless, that there will certainly be obstacles to the Gold Card Program elevating inquiries relating to whether Legislative intent in approving the EB-1 Program and the EB-2 Program is mirrored by the Executive Order.

One more factor that continues to be uncertain is whether private candidates can include their by-products in the donation quantity; that is, does the required contribution amount ($1 million for the Gold Card and $5 million for the Platinum Card) apply to just the candidate or rather apply to the applicant, as well as the candidate's spouse and any of their youngsters under the age of 21? If the previous, after that a family members of four would require to donate $4 million for the Gold Card and $20 million for the Platinum Card.

This concern will certainly require to be resolved in any type of final action taken in ordering the Gold Card Program. One more unclear topic connects to the vetting that would be undertaken under the Gold Card Program. Under the EB-5 Program, each candidate and, more significantly, each applicant's resource of funds, undergoes an exceptionally detailed forensic analysis.

The 10-Minute Rule for Gold Card Visa

The IPO would be the most rational unit to provide the Gold Card Program, offered its experience in carrying out the EB-5 Program; nevertheless, adding the concern of administering the Gold Card Program to the IPO would likely decrease adjudications for the EB-5 Program. One more factor to consider associates with the tax treatment for candidates for the Gold Card and the Platinum Card.

on various other temporary visa classifications, and that take care to stay clear of conference what is referred to as the "substantial existence" examination. Therefore, the initiative by the Administration seems to draw in such people to invest in the united state by getting a Platinum Card. Just how the tax obligation exemption will certainly be accomplished without an amendment of the United state

The Best Guide To Gold Card Visa

Ultimately, eventually is important to vital the Administration's management in proceeding with continuing Gold Card Program. Head of state Trump has long talked of his need to concentrate on modifications to legal immigration and to permit financial investments to decrease the public debt. It is likewise vital to consider that there is global criterion for a two-tier program framework where one program concentrates on a "donation platform" while an additional focuses on an "investment program".

Additionally, but also for the EB-5 Program, numerous realty growths, both in country and metropolitan areas of the united state, would not have actually been prompt completed or completed in any way. In recap, while the Executive Order represents a vibrant and unusual attempt to line up immigration policy with foreign contribution to the united state

Gold Card Visa - Questions

The brand-new program would certainly act as methods to satisfy the "outstanding capacity" demands of the existing EB-1 and EB-2 visa paths for aliens with amazing or outstanding capability. Some 80,000 Trump Gold Cards will be provided, according to united state Commerce Secretary Howard Lutnick. Extra advice is expected, as the EO likewise purchased the Secretary of Commerce, the Secretary of State and the Secretary of Homeland Safety to take all required and suitable steps to execute the Gold Card within 90 days of the order.

long-term homeowners and people are currently based on united state tax obligations and reporting on their around the world earnings. This suggests that U.S. permanent citizens and citizens need to pay federal revenue tax obligations on earnings gained outside the United States. The Management did, nonetheless, additionally hint at a Platinum Card for a $5 million monetary contribution that would certainly "allow private applications to stay in the United States for approximately 270 days annually without being subject to tax obligation on non-U.S.

citizens and permanent homeowners, as these Platinum Card recipients would certainly have the ability to spend a bulk of their time more info in the USA without going through income tax obligations on their international revenue. This program is not yet readily available yet is reportedly in the jobs; Lutnick suggested that the program would certainly require congressional authorization before they can formally introduce the $5 million-per-applicant program.